- The Startup Graveyard

- Posts

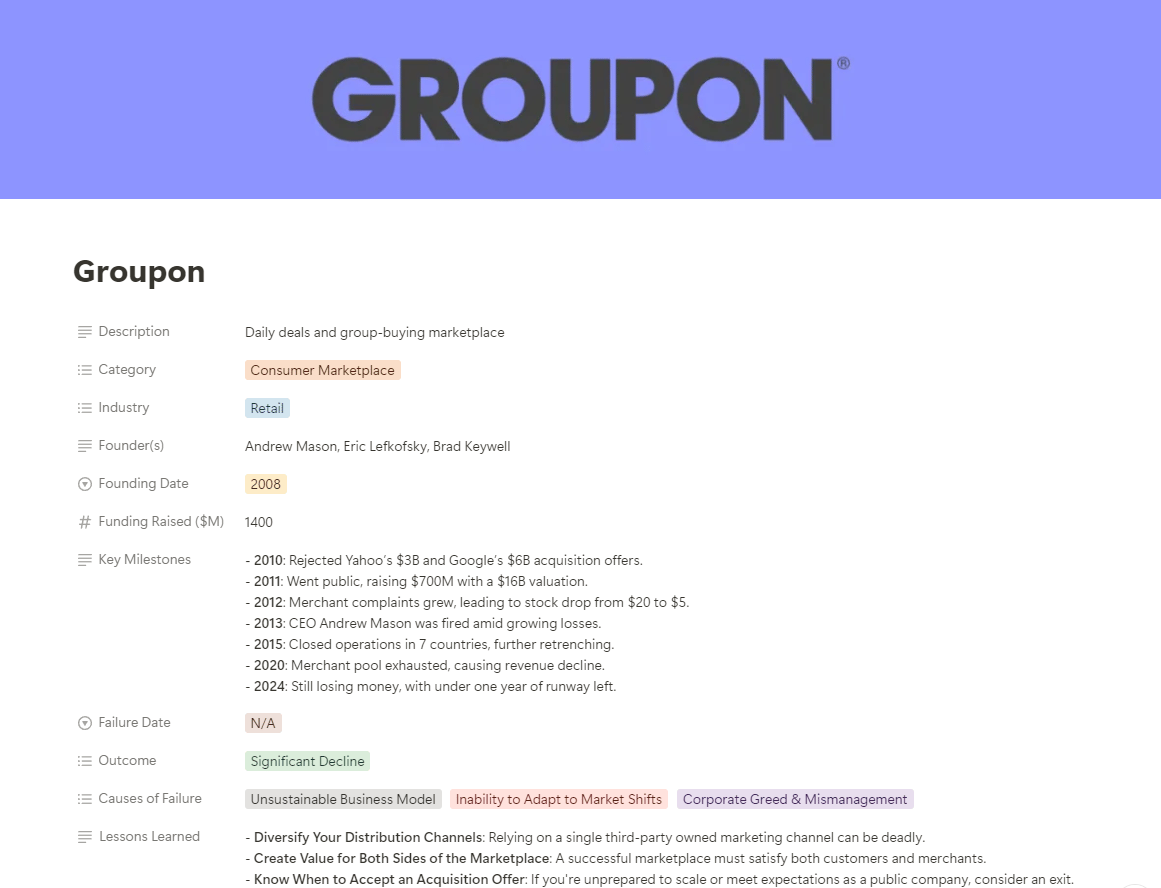

- Groupon: The Fastest Growing Startup in History

Groupon: The Fastest Growing Startup in History

From a $16.6B IPO to Just One Year of Runway

Groupon Overview

The Rise & Fall of Groupon

Groupon’s story began in Chicago during the 2008 financial crisis. Consumers were eager to save, and local businesses needed new ways to attract customers. This set the stage for Andrew Mason, Eric Lefkofsky, and Brad Keywell to launch Groupon. The idea was simple yet innovative: people could purchase local experiences—everything from dining to spa services—at deep discounts, but only if enough buyers signed up. This model was a win-win: customers scored deals, and businesses gained new clients without the costs of traditional advertising.

The Immediate Success

By the end of 2009, Groupon had expanded to 35 U.S. cities, and within a few short years, it was operating in over 30 countries. In 2010, its revenue surpassed $500 million, and at its peak, the company was adding over a million new subscribers every month, making it the fastest-growing tech startup in history. Both Yahoo and Google made acquisition offers of $3 billion and $6 billion, respectively—offers that Mason both declined. At the time, he believed Groupon could reach a higher valuation by staying independent.

The Post-IPO Reality

In 2011, Groupon went public, raising $700 million at a $16.6 billion valuation—an impressive feat for a three-year-old startup. But the post-IPO hit hard. Shortly after going public, Groupon reported a $37 million loss in its first quarter, causing the stock to plummet. Investors also criticized the company for using adjusted earnings to mask financial issues.

Groupon’s early success was driven by consumer demand for discounts, but businesses soon realized it wasn’t a sustainable way to gain loyal customers. Deeply discounted offers failed to create loyalty, leading many merchants to churn after just a few deals. This forced Groupon into a cycle of constantly acquiring new merchants to keep the app active.

The Downfall

As Facebook and Google ads became more cost-effective, many SMBs moved away from Groupon. Regional competitors and copycats also emerged, forcing Groupon to acquire smaller rivals to maintain its leadership. The situation took a bad turn when a policy change from Google caused Groupon’s emails to land in users’ spam folders. Despite efforts to diversify, such as launching Groupon Goods to compete with Amazon on merchandise, nothing could replace the value of their email list.

In 2013, Andrew Mason was replaced as CEO by Eric Lefkofsky. Despite this leadership change, Groupon continued to struggle with its core business model, undergoing multiple rounds of restructuring. By then, the group-deal model had lost its appeal, and businesses had found more effective ways to advertise.

The New Normal

Today, Groupon still operates, but on a much smaller scale. Following several leadership changes, Groupon shifted to a more sustainable model focused on local experiences, travel deals, and targeted promotions. Though it has found a niche, the company currently operates with about a year left of runway.

What Went Wrong?

Unsustainable Business Model

Groupon's business model worked well to drive short-term sales but struggled to build long-term value for merchants. They found that the discounts didn’t attract loyal customers, and as a result, many merchants churned. To keep the growth engine running, Groupon was forced to spend heavily on acquiring new merchants, which became unsustainable over time.

Inability to Adapt to Market Shifts

As the digital marketing landscape evolved, Groupon’s model became outdated. Facebook and Google emerged as more cost-effective platforms for SMBs to advertise online, offering better targeting and lower costs. Meanwhile, Groupon struggled to diversify beyond coupons and failed to adapt to the changing market.

Corporate Greed & Mismanagement

Groupon’s decline was driven by a series of poor strategic decisions. A pivotal moment was in 2010 when Andrew Mason declined Google’s $6 billion acquisition offer. The company also faced backlash after airing a controversial Super Bowl ad. Even after Mason’s departure, Groupon continued to struggle with a lack of clear strategic direction.

Key Lessons

1. Diversify Your Distribution Channels

Relying on a single, third-party-owned marketing channel—like Groupon did with email—leaves your business vulnerable. A well-rounded distribution strategy, across multiple channels, builds resilience.

2. Create Value for Both Sides of the Marketplace

A successful marketplace must deliver value to both customers and merchants. If one side feels exploited—like Groupon's merchants eventually did—the entire model can quickly fall apart.

3. Know When to Accept an Acquisition Offer

Sometimes, accepting an acquisition offer is the smarter choice, especially if you're unprepared to manage a fast-growing public company. If your startup lacks a clear path to profitability, it may be better to take an exit.

Thanks for reading the second article of The Startup Graveyard. If you're curious to dig deeper on Groupon, check out these resources: Company Man, TechCrunch, YC.

Make sure to follow @startupgravyd on socials for bite-sized content,